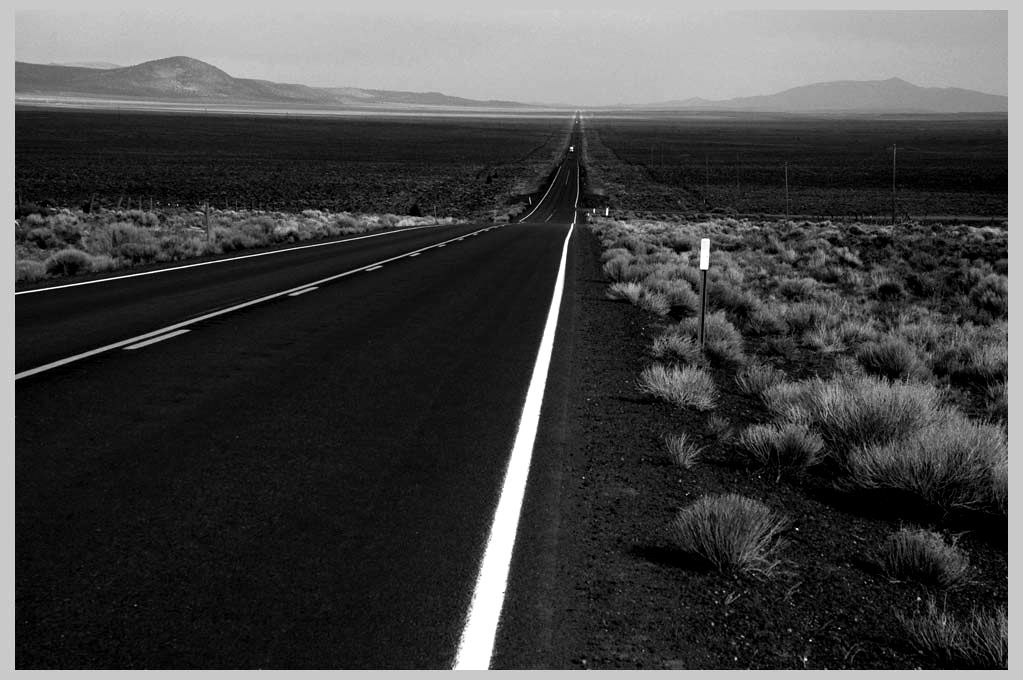

RIGHT OF THE LINE! biking from Bend to Burns on [click photo for next . . . ]

Hwy. 20 ! (XI.17.08) . . .

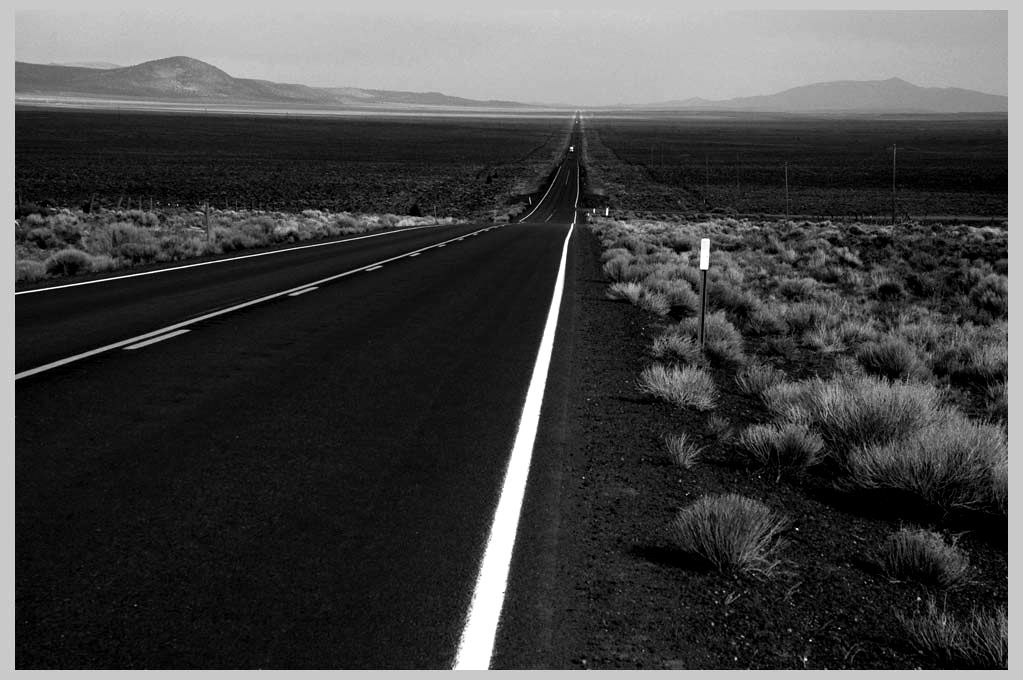

RIGHT OF THE LINE! biking from Bend to Burns on [click photo for next . . . ]

Hwy. 20 ! (XI.17.08) . . .

While biking down straight road to infinity like

this one, I often remember and recite for comfort one

of my Miniatures, like the one that goes:

"A free economy

is a strictly limited one.

Even the busiest of thoroughfares

still retains

a thin white line,

protecting the rights

of those of us who prefer to walk."

(or bike, as is here

the case...)

#art #poster A FREE ECONOMY is a strictly

limited economy http://bit.ly/TWsMNi

pdf http://bit.ly/Q8Jb3h

OUT OF CONTROL—the runaway economies

of systemic imbalance

I have argued elsewhere, that all truly free economies

are necessarily strictly limited ones. This goes, of course,

radically against the prevailing metaphysics that freedom

increases with the decrease of regulation. Let's see why.

The model I like to use is that of an essentially self-regulating,

self-organizing network of highways. The point I like to make

is that systems of roads function as well as they do because

they are ordered not on principles of control—that is, rules

that tell you what to do—but rather on principles of limit—that

is, rules that tell you what not to do, like no faster or slower

than x.

My contention is that a small set of clear, unambiguous

rules or limits is a hallmark of all self-organizing systems.

(A rule of thumb—with no play on words intended—is that,

if you have more limits than fingers on one hand, something

is wrong. One ought always be able to tick off the rules

quickly and rhythmically as a test of clarity.) What do I mean

by self-organizing? Well, in human terms, the key feature

of self-organization is that it requires little or no policing.

In other words, the system exhibits natural in-built safeguards

against, and correction of, all breaking of limits. I don't want

to crash into you, and you don't want to crash into me, so

we naturally both readily accept all such reasonable limits.

Another way of saying the same thing negatively is: a self-

organizing system has failed, that is, has demonstrated an

inappropriate or ill-designed set of limits, when it is in need

of continuous control by use of force. The key point I would

like to make here, is that this is a systemic problem, and not

an ethical one concerning a few individuals of questionable

moral character. For example, in my view, current US drug

laws are a textbook illustration of such failure, causing far

more suffering and disorder than they eliminate, both on the

streets of North American cities and in the developing countries

where source plants like poppies and coca are grown.

(Even conservative economist Milton Friedman thought this

to be the case.) So, excessive use of force by the State in

democratic countries is, in the view being sketched here, a

plain indication that somewhere in the background of an

arcane legal system lurks a poorly conceived, self-defeating

labyrinth of unjust laws and self-serving legislation.

So, what would a clear set of self-organizing limits for a free

economy look like? In this miniature, I'm not going to answer

this question directly. Rather, I'd like to state by way of two

examples drawn from current financial headlines what a truly

free—and therefore strictly limited—economy would not look

like.

In 1999, the Clinton administration repealed a key depression

era piece of legislation known as the Glass-Steagall Act.

This act was designed to keep—in other words, to limit—

savings and speculative investment banks separate.

Repealing the act removed the limits, thus effectively giving

government sanction for bankers of all stripes to imprudently

throw the dice, so to speak, with the money in our savings

accounts.

A second crucial misstep occurred in 2004 when under the

Bush administration, then chairperson of Goldmen Sachs and

now Secretary of the Treasury, Hank Paulson, convinced the

Securities and Exchange Commission to lift limits on required

investment capital.* This led to the remarkable situation that,

when Bear Stearns went under, they were leveraging, to use

an ugly phrase, 33 dollars of debt on every dollar of equity, to

use another equally cumbersome expression. In other words, the

1930's depression era saying, "A dime will get you a dollar," had

become under Secretary Paulson's influence, "Three cents

will get you a dollar!"

Now, to continue with our analogy of a self-organizing and

self-regulating network of highways, the repeal of Glass-Steagall

and allowing the savings and investment branches of the

banking system to merge, is the roadway equivalent of allowing

NASCAR to run races freely on the Interstate. And to add insult

to injury, the 2004 repeal of capital limits is the equivalent of

giving the fastest and most high-powered of those race-cars a

loan of essentially free gas (3 cents on the dollar..) The result

has been, as everyone now knows, catastrophic. The collapse,

in my view, while not perhaps in all its on-going gory details,

but rather in its general outline, was completely predictable.

And what is more, it is not the mere result of the greed of 'a few

bad apples,' but I would argue of systemic poor design. That is,

the utter failure to compose a clear set of unambiguous limits.

Again, just as is already universally the case with networks

of roads around the world.

My central point, however, does not concern the details of

reform that would lead to less corruption and a more equitable

distribution of wealth and access to resources, but rather one

of basic logical necessity. Most readers are probably already

aware, that, in the recent US election cycle, Mr. McCain

received about seven million dollars in backing from Wall Street;

While Mr. Obama received about 10 million. My contention is

that, as long as it is possible to purchase influence in this way,

and on this scale, the economy must necessarily be skewed

to the expensive racecars of the already reckless hyper-rich,

resulting in a continuous cascade of unnecessary and

unpredictable pile-ups and crashes. And, if we fail to take

heed of this basic difference between, on the one hand,

intelligent limit, and on the other, rigid mechanical control or

regulation, then we had better prepare ourselves for more

self-induced world-wide economic runaways charging headlong

into degenerative chaos. As Virgil has it in his arresting image

of his Georgics: "The world is like a chariot run wild,

that rounds the course unchecked, and, gaining speed,

sweeps the helpless driver onto his doom."

Pine Lakes Camp,

Eagle Cap Wilderness,

Oregon, X.29.2008

* data drawn from an excellent Democracy Now! interview (X.17.2008)

with Paul Craig Roberts, former Assistant Secretary of the Treasury

Department in the Reagan administration and a former associatee

e ditor of the Wall Street Journal.

Featured gallery, mountain water . . . .If you're a picture-poems fan, please visit my Living Water Gallery—some of

the best of my flowform photography w/ a selection of the highest quality

prints & frames . . . [ mouse over for controls / lower right fro full-screen ]